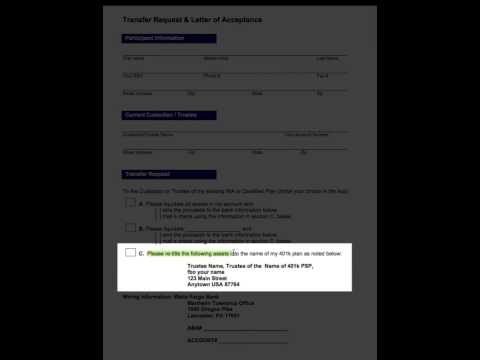

Okay, congratulations! You have established your 401k and checking account. Now, it's time to start moving your assets into the retirement plan. How do you do that? Well, we have a form for doing this. Let's walk through it step by step. First, a big warning about surrender fees. Many times, your current investments will have surrender fees. Make sure you know what, if any, surrender fees will be due by moving these assets to your brand-new self-directed retirement plan. Another issue to be aware of is that your current custodian or employer may have a form for you to fill out in order to request those funds. If that's the case, use their form. You don't need to use this form. Also, please note that whoever we set up the checking account with, for example Wells Fargo, is not your custodian or third-party administrator. Their role is strictly to provide the checking account for you. So, if your current custodian asks for Wells Fargo to sign something, it's not going to happen. You are the trustee of your 401k plan, and it's you who will sign and present that document. One final aspect to consider is that you cannot roll over or transfer a Roth IRA into your 401k. This 401k has Roth features, but you can only transfer or roll over a Roth 401k account into another Roth 401k account. You cannot transfer a Roth IRA into a Roth 401k. Now, let's get to the meat of the matter. Up top, we have participant information. That's you! Simply fill out your name, social security number, phone number, fax number, street address, city, state, and zip. Next, fill in the information for the current custodian or trustee. This is the entity currently holding the money or assets of your retirement plan. Provide their name, your...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 8815 Distribution