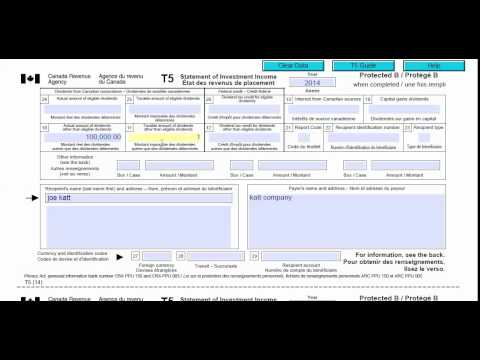

The T5 2014 form is used to report dividends paid from private companies. This video tutorial will guide you through the process of filling out the T5 form to report dividends paid in 2014. The form can be easily found on the Canada Revenue Agency website. To begin, fill in the year as 2014. Next, provide your company's data, including the company name (let's use "Kent Company" as an example) and your name (let's assume it's Joe Cat). The form requires you to fill in certain es for reporting dividends. es 10, 11, and 12 are used to report other than eligible dividends. Unless your income is very high (over $500,000 in taxable income), you will report your dividends in these es. Suppose your company paid you $100,000 in dividends. In 10, fill in the actual amount of other than eligible dividends as $100,000. Moving on to 11, the taxable amount of dividends, the formula for 2014 is different from previous years. The formula is $100,000 multiplied by 1.18 (1.18 represents 118% of the actual amount). Thus, the taxable amount in 11 will be $118,000. In 12, you need to calculate the dividend tax credit. This is 13% of the amount in 10. So, if 10 is $100,000, the dividend tax credit in 12 will be $13,000. The only other information required on the form is in 22, where you need to provide your social insurance number (a nine-digit number). Fill in this number accordingly. Additionally, provide your address and your company's address on the form. That completes the T5 form. The next step is to fill in the T5 summary, which can also be found on the CRA website. Following the instructions, enter the year as 2014 and your company's nine-digit business number (let's use 852222358 as an example)....

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 8815 Dividend