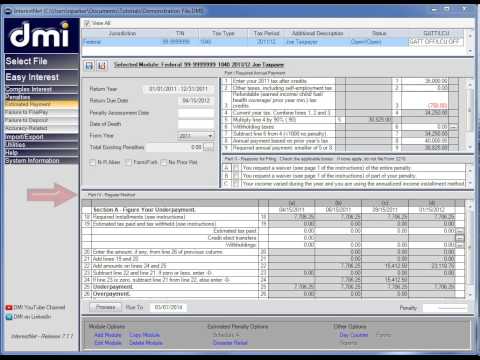

Thank you for your interest in Diem Ice Interest Net software. Let's take a look at one of its many features. Interest Net gives users the ability to set up and calculate a variety of IRS penalties. In this video, we will look at the estimated payment penalties. These penalties are accessible from the navigation bars penalties group. Upon selecting the estimated payment option, you will be prompted to create a new data file if you have not already done so. Click yes and type the name you wish to give your data file, then click the Save icon. Select the designated area you wish to save your file and click Save. Upon creating the data file, a default tax module will have already been added to the module list at the top of the screen. Since this module was automatically added to the system, the Edit module screen will automatically be displayed as well. This is where the user can set the defining parameters of the tax module. Use the available controls on the screen to select the parameters for the module, such as jurisdiction, tax type, interest rate table, and tax period. You may also edit the description and tax ID if desired. In this case, we will set up a module for form 1040 return for the year 2011 for GEO taxpayer. Note that unlike some of the other penalties in Interest Net, where the defining parameters for the module have little or no effect on the results and are for presentation purposes only, for the estimated payment penalties, it is crucial to at least properly establish the tax type and period of the module. These parameters establish whether the penalty will be the corporate or individual variety, form 2020 or 2010 respectively, as well as the due date...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 8815 Penalties