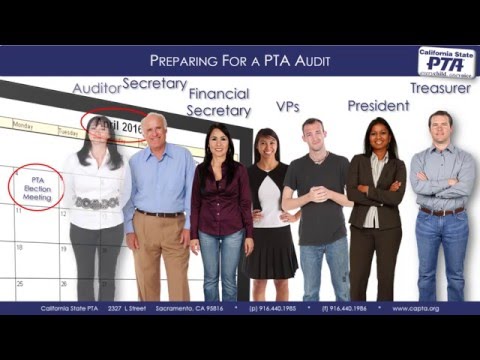

Preparation for a PTA audit begins in March or April, closely following the election of new PTA officers. PTA officers and board members are legally responsible for the care of PTA finances. The best practice is for the president-elect to call a meeting of the board elect. At the board meeting, the auditor explains PTA audit requirements, which financial records and internal controls will be audited, and the audit schedule. The auditor explains that PTA bylaws require semi-annual audits, ed mid-year and at year-end. Additionally, an audit is also required upon resignation of the treasurer, financial secretary, or any checks signer. The auditor explains that all of the items in the description section of the audit checklist will be required to complete the audit. It is considered best practice to organize the records and folders in the following manner: - In the income folder, place all cash verification forms and their corresponding bank deposit slips. - In the payments folder, place all payment authorization forms and their corresponding receipts and invoices. - In the remittance folder, place all unit remittance forms and workers' compensation annual payroll report forms. - In the ledger register folder, place printed copies of the ledger and checkbook register. - In the cash receipts folder, place copies of cash receipts. - In the bank statements folder, place reconciled bank statements and canceled checks or images of canceled checks. - In the financial reports folder, place all financial reports. - In the budget folder, place copies of the budget and budget updates. - In the minutes folder, place all association and board meeting minutes. The auditor then explains the internal controls that will be audited. Controls that protect PTA's income include the rule that two people must receive, open, and count all money received, and that money received must be immediately deposited into a PTA bank account. The...

Award-winning PDF software

Video instructions and help with filling out and completing Form 8815 Audit