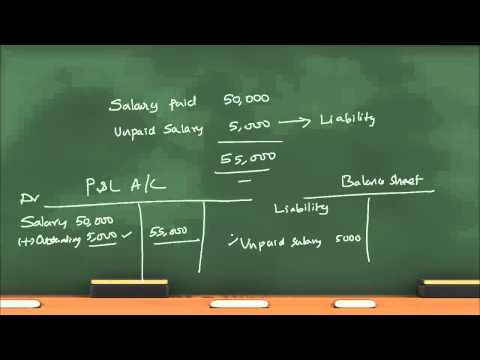

Students, this is the second adjustment in fine lagoons that is outstanding expenses. The trial balance shows that the salary paid is fifty thousand rupees, but the adjustment states that the salary for March 2014 was not paid, amounting to five thousand rupees. Servants, this is the concept with which we have introduced the concept of adjustment. So the concept should be simple for you. This outstanding expense should be accounted for because of one fundamental concept called the accrual concept. The accrual concept states that if certain expenditures have been incurred in the accounting period, whether they are paid or not, they should be accounted for. The question of payment on time or not is a matter of cash flow management. If you have cash, you will pay; if you don't have cash, you will pay at a future date. But the point is when this expenditure was incurred. So the salary which is incurred but not paid is an expenditure for that accounting period. Let whenever it be paid, but the point is when it was incurred in that particular point of time, it should be accounted for. What is going to be the accounting effect for this adjustment? We will write that the salary for one full year or salary paid by the company till that date was fifty thousand rupees. So the salary paid is fifty thousand, whereas the unpaid salary is five thousand. So the actual salary expense for the company is fifty-five thousand rupees. So, only when the company shows this entire fifty-five thousand as salary in the profit and loss account, it will reflect a true and fair view. Otherwise, it will not reflect the true and fair view. So when the profit and loss account is prepared, the salary will be shown...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 8815 Prepaid