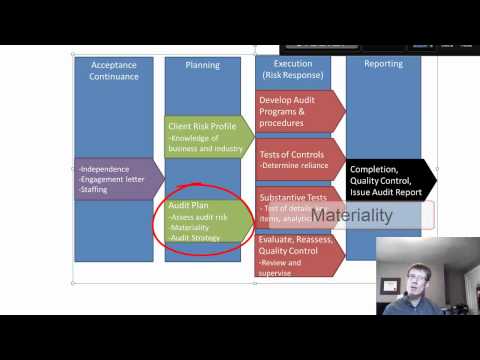

In this lesson, we're going to do a high-level run-through of the audit process so that you get a feel for what an audit is and how it's conducted. The rest of the course will take a deeper look into each of these audit procedures. Let's pretend that our client is Lakeview Hotels, a small capitalization public company that operates a small portfolio of hotels across the country, and we work for Early and Young Public Accountants. Here's a bit of background: Lakeview has been a client for the past four years. The company has been negatively impacted by the slow recovery in the economy and its older properties. Two years ago, Lakeview outsourced the management of its hotels to an external manager. Lakeview's corporate staff are responsible for the oversight of the managers, the strategic decisions, the financing decisions, and of course, preparing the public reporting. Lakeview CEO is a seasoned veteran of the hotel industry. The CFO has been with the company for the past three years and does not have a background in hotels. The company is faced with a significant maturity of a debenture. With that background in mind, let's walk through the high-level audit process. Let's start with the end in mind – an audit is the expression of an independent opinion on the fairness of the presentation of the financial statements as prepared by management. Two important points to make here: first of all, the responsibility for the preparation of the financial statements lies with management and not the auditors; and secondly, the auditors are responsible for their opinion, which is based on the evaluation of audit evidence they gather. So, put in the simplest terms possible, an audit is intended to ensure that every number and every disclosure within the financial statements is...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 8815 Audit