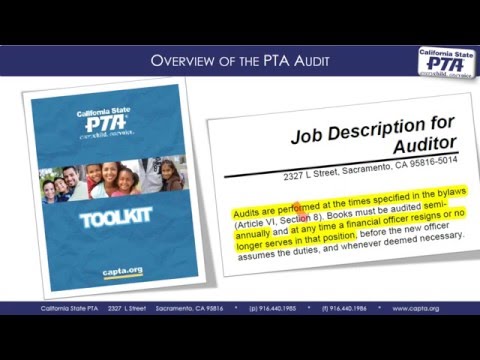

The California State PTA toolkit explains the PTA audit. To access the toolkit, go to the Capt a org website and click on the finance tab. Then, select PTA audit from the drop-down menu. The toolkit contains information on the audit schedule, the purpose of an audit, preparation for an audit, audit procedure and recommendations, and the audit report. It also includes a job description for a PTA auditor. The PTA auditor is an elected PTA officer and member of the PTA executive board. If an auditor was not elected, one may be appointed or hired. However, the auditor must be impartial and cannot be related to the president, financial officers, any PTA check signer, or chairman that handles PTA funds. Audits are conducted at times specified in the bylaws. PTA books must be audited semi-annually and anytime a financial officer resigns or no longer serves in that position. A PTA audit is a formal review of the PTA's financial records and internal controls. PTA financial records include financial records, financial reports, and financial forms. The PTA executive board and auditor should be familiar with each of these records. The ledger is the principal book for recording financial transactions. It is used to track all receipts and disbursements. The ledger is a permanent record that must be retained forever. The checkbook register is used to track the balance of the checking account. All bank deposits, checks written, and any other account debits and credits are recorded and balanced in the checkbook register. The cash receipt book is used to track coins and dollar bills received. The treasurer or financial secretary must write a cash receipt for any coins or dollar bills received. Cash receipts must be retained for seven years. Monthly bank statements with copies of canceled checks must be retained for seven years. Deposit slips are...

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 8815 Audit