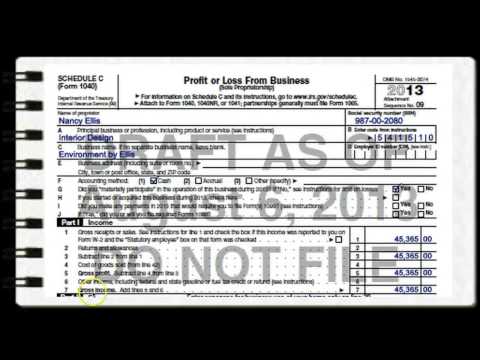

Welcome to self-employment. This is lesson 2, and we are going to look at the income that you make if you are self-employed, as well as the additional taxes that you might end up owing. Our objectives today are to understand what is self-employment income, to understand and calculate self-employment tax, and understand what tax forms are required to be used for self-employment income, as well as the taxes associated with that. So, what are self-employed individuals? These are individuals who are independent contractors. They're not employees of somebody else. So, if you go out and babysit, for example, you are a self-employed individual. If you go around your neighborhood and cut lawns for people or shovel snow, you are considered to be a self-employed individual. There are obviously varying levels of self-employed individuals, ranging from a babysitter all the way up to somebody who actually runs and owns a business and has their own employees. Self-employment or self-employed income, expenses, profit, and taxes are reported. Well, we haven't looked at Form 1040 yet, but if you have a business that's owned by just one person, these are always reported on Form 1040, but first organized and set up on Schedule C. If you have a business that has profit, most likely you'll have to pay self-employment taxes for this business. Those are calculated and reported also on 1040, but they come over from Schedule SE, where they are organized and the tax is calculated. When you work for somebody else as an employee, you pay Medicare and Social Security, and your employer also pays Medicare and Social Security on your behalf. So, whatever you pay, your employer matches that. When you have your own business, you have to pay both portions, and that's what Schedule SE calculates for you....

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 8815 Employed