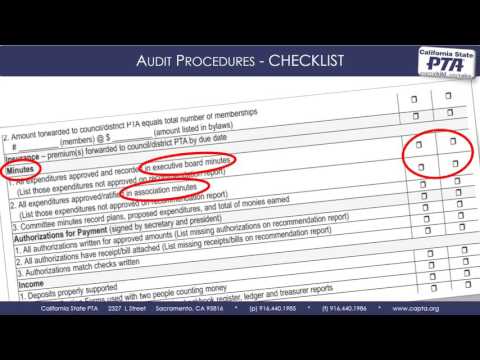

PTA audit procedures require the use of PTA's audit checklist and audit report form. - To download these forms, go to the California State PTA website at WWC a PTA org. - Click on the PTA leaders tab drop-down to run your PTA and click on forms. - Use a separate audit checklist and audit report form for each PTA bank account to be audited. - Begin by ensuring that all items in the description section of the audit checklist have been handed over for audit. - Check off each item one by one, including the employment forms if required. - Immediately contact the appropriate officer (usually the treasurer, secretary, or president) and request any missing items. - If all items have been provided, check "yes"; otherwise, check "no". - Next, audit the beginning balance for this accounting period. - Check the balance of the previous audit report and compare it to the beginning balances of the first bank statement for this accounting period. - Compare it to the ledger and the checkbook register, and then compare it to the first treasurer's report for this accounting period. - If these beginning balances all agree, check "yes"; otherwise, check "no". - Next, audit the bank statements. - Verify that each of the bank statements was opened and reviewed using PTA's 5-minute audit by an elected officer who is not authorized to sign checks. - Look for the officer's signature or initials. - Verify that each statement was reconciled by the treasurer. - If each of the bank statements was properly opened, reviewed, and reconciled, check "yes"; otherwise, check "no". - Check the balance of the last bank statement and verify that it matches the ending balance of the checkbook register, ledger, and last treasurer's report. - If these ending balances all agree, check "yes"; otherwise, check "no". - Verify that each deposit and check that appear on bank statements match...

Award-winning PDF software

Video instructions and help with filling out and completing Why Form 8815 Audit