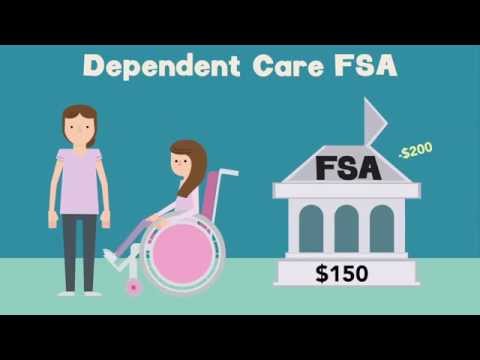

A dependent care flexible spending account (FSA) is pre-tax money you set aside out of your paycheck to cover daycare costs. With a dependent care FSA, you can pay for fees for licensed daycare or adult care facilities, as well as before and after school care programs and summer day camps for dependents under 13. The money you put in your FSA is taken from your pay before federal, state, or social security taxes. This decreases your taxable income and increases your take-home pay. So, how does an FSA work? When choosing your benefits, you must decide how much money you want to put in your dependent care FSA for the entire year. Although there are limits, the amount you choose for the year is taken out of your paycheck in equal amounts and placed in your flexible spending account. Unlike a Health FSA, where you have access to your total contribution for the year on the first day your benefits become active, with your dependent care FSA, you must have enough money available in your account to cover any expenses. Unlike a health FSA, where you can carry over up to $500 to the next year, with your dependent care FSA, you are not able to carry over any unused dollars. So, use it or lose it. Now, you may be wondering how to get your money out of the FSA to pay for these expenses. Most FSA plans offer an FSA debit card, which allows you to pay for approved expenses directly at the place you get care or buy medicine. The card will only work for FSA-eligible expenses and is the most convenient way to use your FSA. If your FSA doesn't offer a debit card, you will pay out of pocket and then send a copy of the receipt...

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 8815 Dependents