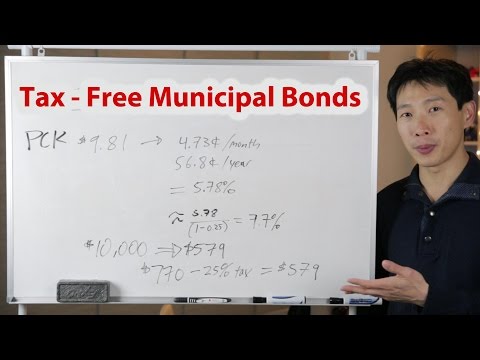

How's it going, everybody? This is Beat the Bush. Today, I'd like to introduce you to a class of assets that you should really know about. Now, what I'm talking about is tax-free municipal bonds. For whatever state you're living in, you're likely to be able to buy municipal bonds in your own state that will make it tax-free. For California, for example, you can buy stock ticker symbol P CK, which is a municipal bond. Now, the current price on this in April 2007 is actually about $9.81. Every single month you hold this share, you're actually going to get $0.473 every single month. This translates to every single year, you're going to get $56.80. If you look at the history, they do give the payout pretty consistently. And if you work that out, it's 5.78 percent (56.8 divided by 9.81). Now, the critical and really good thing about this is that if you're a working full-time person, let's say you make $50,000 a year, you are in the 25 percent tax bracket. Now, this money that you earn here is actually tax-free. So, you actually have to earn something a lot bigger if you bought it in a normal stock and got a dividend where you have to pay taxes. So, to figure out how many percent you would be gaining from an actually tax dividend, you do 1 minus 0.25 over here. You get 7.7 percent. Now, 7.7 percent is pretty high for a dividend, and for that type of dividend, you usually get a little bit higher risk. Now, imagine you have $10,000 and you want to invest it somewhere. Well, California municipal bonds are a pretty good way to go. Because if you invest $10,000 every single year, you're going to get $579. This is pretty nice for...

Award-winning PDF software

Taxes on bonds when cashed in Form: What You Should Know

Solving a 150,000 Income Tax Problems for I Bond — D. Gaffe Jul 13, 2025 — You are the beneficiary and have not included in your income any interest, dividends, or capital gain on the bonds. You can't exclude the interest. Report the proceeds in income on Form 1040. The amount should have shown as capital gain in box 2a or 2b of Part II of Schedule D. IRS, 8 C.F.R § 301.90, 8 CFR § 301.90, 5 U.S.C. 521; 8 U.S.C. § 1322(d)(3)(B) Sep 2, 2025 — The interest on I bond is includible in your income when the bonds mature or are redeemed. Saving Bonds — IRS Sep 2, 2025 — If you redeem the bonds, you should include the interest on both your federal income tax return (Form 1040) and the return you make to the IRS. E-Guide — IRS Sep 5, 2025 — If you have more than 5,000 in the account at any time during the tax year, and you are a joint taxpayer, you must report the interest on Part 2 of Form 1040. For paper savings bonds — TreasuryDirect Sep 2, 2025 — If you redeem I bond, the interest has to be included in income when the bond matures (or is redeemed), or was received. I Bond, 10-K — Kip linger Sep 8, 2025 — Interest on I bond is includible in income. Any earnings in excess of 2,000 are subject to a 10% tax. Interest and Dividend Exclusion : In general, the holder(s) are taxed as individual taxpayers on any interest and dividends received. Interest Exclusion : Generally, you are taxed on only the interest income as described above. If you have a large withdrawal, you may be able to benefit from the interest and dividend exclusion. As a result, you will have to file IRS Form 8825, Statement of Treatment, to show the exclusion. Form 1099-B — Kip linger Sep 8, 2025 — If you are a holder of a U.S. Savings Bond with a cash basis of more than 5,000, report the interest income as earned income in the taxable year.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8815, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8815 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8815 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8815 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Taxes on bonds when cashed in